Key Real Estate Amendments in Finance Act, 2023 | Budget 2023 -24

Introduction

The real estate sector in Pakistan has been subject to significant regulatory changes with the recent enactment of the Finance Act, 2023. These amendments are aimed at promoting transparency, enhancing tax compliance, and boosting the government’s revenue from the real estate market. In this article, we will explore the essential changes introduced by the Finance Act, 2023, and their potential impact on the real estate industry.

Adjustable Advance Tax on Area Basis for Builders & Developers

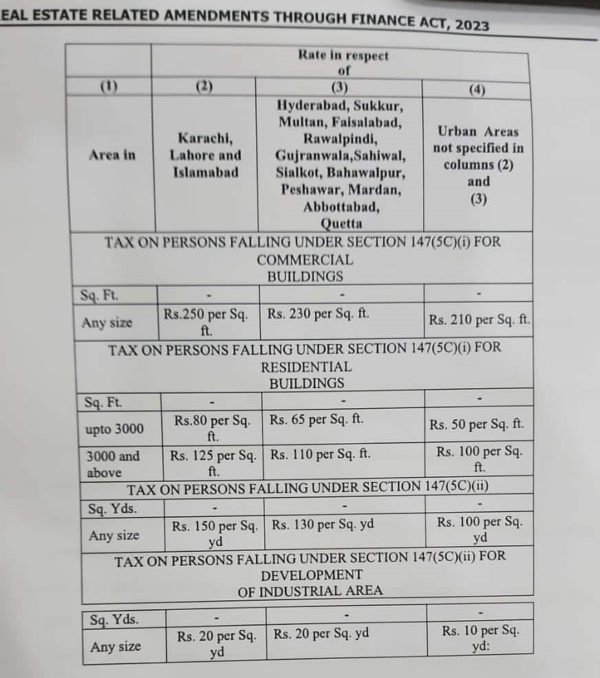

One of the primary changes introduced by the Finance Act, 2023, is the requirement for every builder and developer to pay adjustable advance tax on an area basis for each project. This means that taxes will now be levied based on the size of the property development project. The tax rates per square foot are provided in the official documentation, ensuring clarity and standardization across the industry. This measure is expected to streamline tax collection and prevent potential tax evasion practices prevalent in the real estate sector.

Evidence of Tax Payment for Property Transfers

To ensure tax compliance and transparency, a crucial amendment prohibits the registration of transfers of immovable property unless the seller or transferor provides evidence of payment of tax under Section 7E. This move intends to bring more accountability to property transactions and curb the practice of underreporting property values to evade taxes.

Withdrawal of Tax Credit for House Construction

The Finance Act, 2023, has withdrawn the tax credit previously announced for house construction. This decision may have implications for the construction industry and may impact the demand for new housing projects. Investors and homeowners may need to reassess their plans, considering the removal of this tax incentive.

Exemption Changes for Non-Resident Pakistanis

In a significant shift, the exemption of advance tax on property purchases by non-resident Pakistanis has been withdrawn. Non-resident Pakistanis looking to invest in the real estate market will now be subject to the same advance tax rates as residents, potentially impacting their investment decisions.

Increase in Advance Tax Rates for Filers

The Finance Act, 2023, introduces a higher rate of advance tax for both sellers and buyers who are filers. The advance tax paid by a seller under Section 236C and a buyer under Section 236K has been increased from 2% to 3%. This change aims to bolster government revenue and encourage tax compliance among filers.

Implications for Non-Filers

The Act has also introduced changes that affect non-filers. Non-filers will no longer be entitled to certain exclusions available under Section 7E. This includes one capital asset owned by a non-filer, any property from which income is taxable under the Ordinance with paid taxes, and capital assets acquired in the first tax year where tax under Section 236K has been paid. Additionally, non-filers with aggregate capital assets exceeding twenty-five million rupees will be subject to a flat tax rate of 1% on the fair market value of the assets, without availing any of the above advantages available to filers.